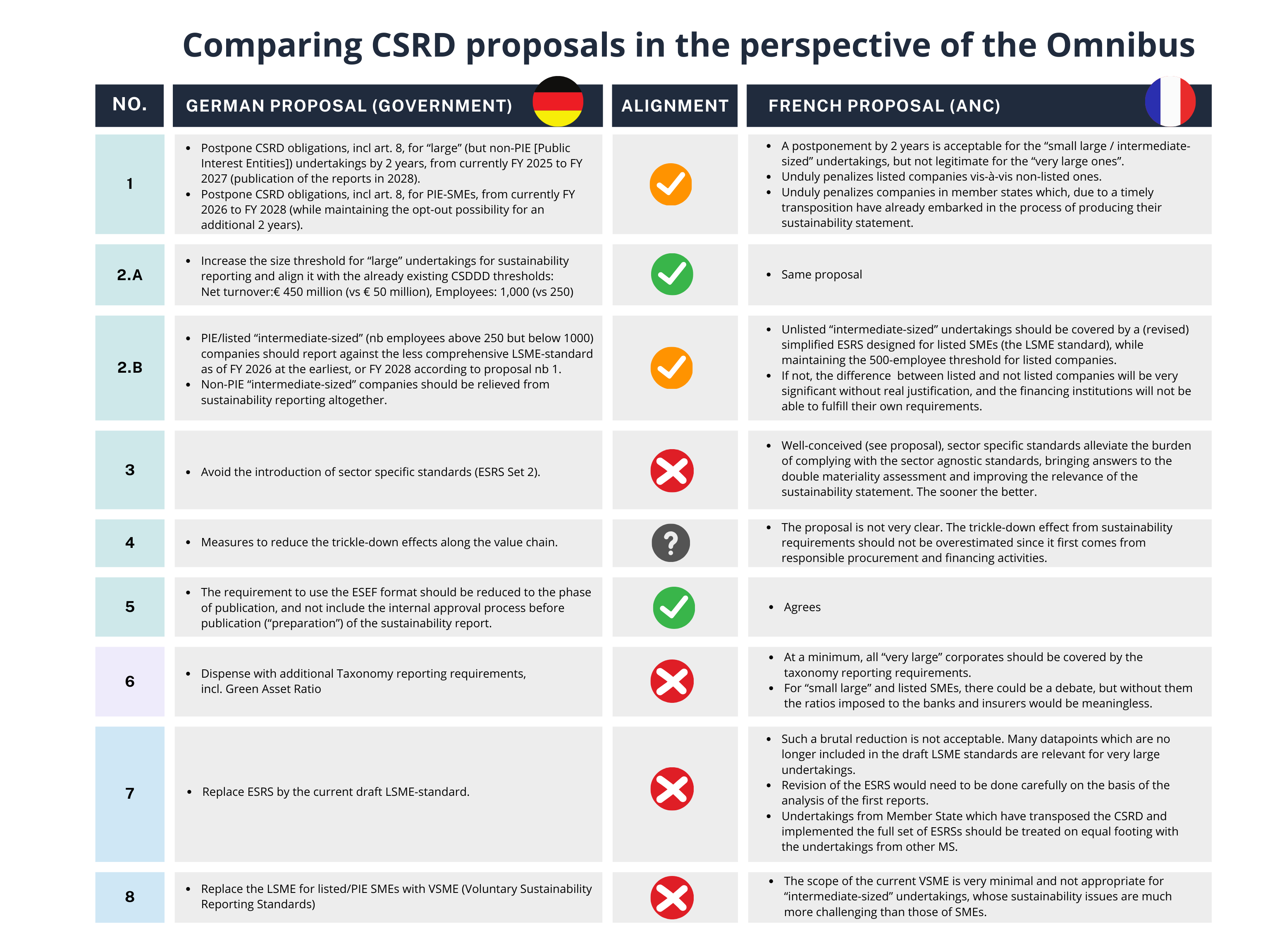

On 31/1 the German DRSC submitted five proposals for the European Commission’s #Omnibus initiative on the evolution of CSRD and ESRS.

The Accounting Standards Committee of Germany (DRSC in German) is the national standard setter in the area of group financial reporting in Germany. As such, it’s the equivalent to the French ANC.

Here’s a recap of the key takeaways from the German DRSC proposal.

Introduce graduated requirements for “mid-cap” companies, harmonize the size thresholds with the scope of the CSDDD and postpone their reporting by at least one year.

Approx. 550 German 1st wave CSRD companies are currently in the final phase of the first preparation of ESRS sustainability reports on financial year 2025.

It is to be expected that, despite the lack of a German implementation law, many of these companies will voluntarily report fully or partially in accordance with the ESRS.

Approx. 14,000 German 2nd wave companies are required to report according to ESRS for the first time for on financial year 2025 financial. They have already begun preparations.

The vast majority of these companies have no experience with non-financial or sustainability-related reporting obligations, as there has not been a legal obligation to date.

They need clear and proportionally designed reporting requirements based on the capacities and capabilities of these companies, with special relief for “mid-caps”.

A definition of “mid-caps” could be based on companies with more than 250 and up to 3,000 employees, or on the CSDDD threshold (1,000 employees; EUR 450 million turnover). The EC should carry out “field tests” on the capabilities of these companies, in order to achieve an appropriate definition.

ESRS Set 1 should be simplified building on the LSME standard, and making sure that the necessary information is available to users (SFDR, CRR and CRD for financial institutions).

Sufficient preparation time is required for the implementation or adaptation of (implementation) projects. Therefore, the initial reporting for these companies should also be postponed by at least one year.

Relieve “smaller” large limited liability companies from mandatory reporting.

Allow them to apply the voluntary VSME standard given their limited resources.

Simplify ESRS Set 1 and adopt a “Climate first” approach closer to the climate reporting requirements set by IFRS S2 (ISSB).

ESRS Set 1 represent “disproportionately high report volumes, which is likely to make it more difficult for users to find information relevant to decision-making, due to the sometimes extremely granular requirements and the associated extensive interpretations and explanations”.

The European Commission should give EFRAG a priority audit mandate to analyse the initial reporting practice, as well as subsequent reporting cycles, with a view to possible simplifications and improvements.

The requirements of the ESRS E1 are much more granular than the information required in IFRS S2. This can result in immediate approaches to reducing the requirements in ESRS Set 1

Pause the development of sector standards until we know if they are really needed.

There are general doubts about the need for sector-specific ESRS. A short DRSC survey among the DAX 40 companies in summer 2024 showed that, in addition to the list of topics listed in ESRS 1.AR 16 or according to paragraph 11, hardly any other company-specific reporting topics were identified by application practice. This indicates that additional sector-specific topics and disclosure requirements are not expected to be covered to any significant extent.

Industry associations should be enabled to develop industry guidelines for their member companies as a starting point.

Delay the reporting for the 2nd wave of companies by at least one year to provide ‘planning security’.

Reporting companies need a stable legal framework in order to implement reporting requirements in a legally secure manner. Constant ‘trial and error’ in regulation should be avoided.

Clearly defined legal requirements from the Omnibus initiative are needed quickly, with sufficient lead time for implementation – meaning at least one more year for effective implementation.

You can also read more about the French ANC’s proposal here: https://www.linkedin.com/posts/leilahellgren_omnibus-activity-7285536308968509440-5pko?utm_source=share&utm_medium=member_desktop