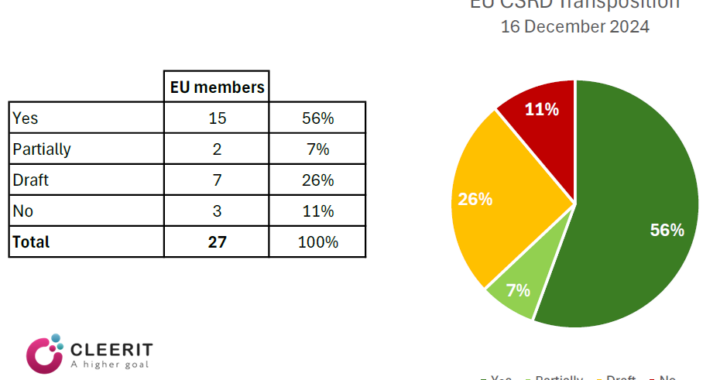

The EU CSRD transposition pace is picking up. 17 member states have now completely (15) or partially (2) implemented CSRD into national law, while another 7 have drafts in process, of which 4 are well advanced.

Only 3 member states – Austria, Malta and Portugal – have (to our knowledge) not started the implementation process.

Download the full document here >>>

| EU CSRD Transposition 16 December 2024 |

| EU Member State | Number of preparers | Share of preparers | Information | Status | |

| 1 | Austria | 1 501 | 3% | The government has not released any draft legislation to transpose the CSRD into local law. The timeline for formal adoption is not set. | No |

| 2 | Belgium | 1 918 | 4% | The Belgian Parliament adopted the act transposing the Corporate Sustainability Reporting Directive (CSRD) on 28 November 2024.https://www.lachambre.be/FLWB/PDF/56/0416/56K0416008.pdf https://www.dekamer.be/kvvcr/showpage.cfm?section=/flwb&language=fr&cfm=/site/wwwcfm/flwb/flwbn.cfm?lang=N&legislat=56&dossierID=0416 | Yes |

| 3 | Bulgaria | 374 | 1% | CSRD was transposed in Bulgaria through the amendments to the Accounting Act and the Independent Financial Audit Act, adopted on 14 August and 4 September 2024 respectively. | Yes |

| 4 | Croatia | 233 | 0,5% | The CSRD requirements were adopted into national law on 12 July 2024 through amendments to a number of local laws, in particular to the Accounting Act (OG No. 85/2024), the Audit Act (OG No. 127/2017, 27/2024, 85/2024) and the Capital Markets Act (OG No. 65/18, 17/20, 83/21, 151/22, 85/24). Published in the Official Gazette on 19 July, the Capital Markets Act took effect immediately, while the others became effective on 27 July 2024. | Yes |

| 5 | Cyprus | 474 | 1% | The Cypriot government introduced a draft bill in March 2024, which would introduce CSRD-related amendments to the Cypriot Companies Law. | Draft |

| 6 | Czechia | 844 | 2% | CSRD is being transposed in two phases: 1st phase: Companies who were already subject to the Non-Financial Reporting Directive requirements (large PIE with more than 500 employees) must comply with the CSRD from 2025 (for financial year starting from 1 January 2024). These requirements were adopted under Act No 349/2023 in December 2023, and took effect from 1 January 2024. 2nd phase: Will extend the CSRD reporting requirements to all other remaining in-scope groups under the Directive, starting with “large undertakings” and “parents of large groups” who will need to comply from 2026 (for financial year commencing from 1 January 2025). On 1 January 2024, Amendments to Act on Accounting, Act on Auditors and Act on Capital Markets (with other acts) entered into force and are binding (published in the Official Journal on 12 December 2023). | Yes |

| 7 | Denmark | 1 168 | 2% | The Danish Parliament implemented CSRD into national legislation on 2 May 2024, with changes to the Danish Financial Statements Act, the Danish Act on Approved Auditors and Audit Firms, as well as Danish corporate and financial legislation. | Yes |

| 8 | Estonia | 141 | 0,3% | The draft law transposing the CSRD was published on 23 February 2024 and is currently waiting for approval from parliament. | Draft |

| 9 | Finland | 835 | 2% | Finland became the second EU Member State to transposed the CSRD into national law. The provisions related to the CSRD entered into force on the 31st of December 2023 and introduced amendments to the Accounting Act, the Auditing Act, the Companies Act, the Securities Markets Act, and related regulations. | Yes |

| 10 | France | 5 932 | 12% | France was the first EU Member State to adopt the CSRD. The Order no. 2023-1142 transposed the CSRD on 6 December 2023, and amended several existing provisions of the French Commercial Code relating to corporate social and environmental responsibility. The decree n° 2023-1394 was published on 30 December 2023. | Yes |

| 11 | Germany | 11 454 | 24% | The Federal Cabinet adopted the Government Draft to transpose the CSRD into German law on 24 July 24 2024, but it is not yet legally effective. It is currently being debated in the German parliament. | Draft |

| 12 | Greece | 470 | 1% | CSRD was transposed into Greek law on 10 December 2024 through Law 5164/2024 (Government Gazette A’ 202). https://search.et.gr/el/fek/?fekId=774755 | Yes |

| 13 | Hungary | 631 | 1% | Hungary’s CSRD transposition framework is provided by the ESG Act, adopted on 12 December 2023. The detailed regulations necessary for auditing and assurance, and also the amount of the fines in case of non-compliance, have not yet been adopted and will be laid down in a government decree. | Partially |

| 14 | Ireland | 762 | 2% | CSRD was transpoed into Irish law on 5 July 2024 (S.I. No. 336/2024, Iris Oifigiúl Number 55). | Yes |

| 15 | Italy | 5 683 | 12% | The Italian legislative decree No. 125/2024 was published in the Official Gazette in Italy on 10 September 2024 (“GURI” General Series No. 212), thereby officially transposing CSRD into Italian law. The law entered into force from 25 September 2024. | Yes |

| 16 | Latvia | 125 | 0,3% | Latvia transposed CSRD by the adoption by the Saeima of the Sustainability Disclosure Act on 26 September 2024 (https://m.likumi.lv/ta/id/355381-ilgtspejas-informacijas-atklasanas-likums). | Yes |

| 17 | Lithuania | 181 | 0,4% | On 25 June 2024, the parliament approved the package of laws transposing the CSRD, which entered into force on 1 July 2024. The package consists of twelve draft laws, of which the main ones are the new Law on the Accountability of Enterprises and Enterprise Groups of the Republic of Lithuania, and the revised Law on the Audit and other Assurance services of Financial Statements of the Republic of Lithuania. | Yes |

| 18 | Luxembourg | 1 603 | 3% | CSRD is in the process of being transposed into Luxembourg law. A draft bill no. 8370 transposing the CSRD was introduced by the Minister of Justice before the Luxembourg parliament on 29 March 2024, amending the Accounting Directive, the Audit Directive, the Transparency Directive and the Audit Regulation. The State Council (Conseil d’Etat) did published their opinion at the beginning of July 2024 (which marks a mandatory step of the Luxembourg legislative process). The Statutory Auditors Institute (Institut des Réviseurs d’Entreprises) also published their opinion on the draft bill in July 2024. | Draft |

| 19 | Malta | 204 | 0,4% | The government has not released any draft legislation to transpose the CSRD into local law. The timeline for formal adoption is not set. | No |

| 20 | Netherlands | 4 087 | 9% | A draft implementation bill (Draft Dutch Decree) to transpose the CSRD was published by the Dutch government on 20 November 2023. The consultation period expired on 18 December 2023. A draft “Decree on implementation of sustainability reporting” was presented to the House of Representatives (Tweede Kamer) on 12 June 2024. It is ready for further formal legislation, but still in draft. After the parliamentary debate, the Implementation Decree will be sent to the Council of State and, upon completion, published in the Official Gazette. In anticipation of the CSRD coming into effect in domestic law, the Dutch AFM has published further guidance regarding its expectations on companies to comply. | Draft |

| 21 | Poland | 1 497 | 3% | On 6 December 2024, after examining the amendments proposed by the Upper House, the Lower House of the Polish Parliament finalized work on the Act amending the Accounting Act, the Act on Statutory Auditors, Audit Companies, and Public Supervision, and certain other acts. The Act was signed by the President on 13 December 2024, implementing the CSRD into the Polish law.A Draft Act implementing the CSRD into Polish law was published on 19 April 2024 on the official legislative website (https://legislacja.gov.pl/projekt/12381804/katalog/13035986#13035986). All interested parties were invited to provide comments within 30 days from the date of its publication. | Yes |

| 22 | Portugal | 701 | 1% | The government has not released any draft legislation to transpose the CSRD into local law. The timeline for formal adoption is not set. | No |

| 23 | Romania | 535 | 1% | CSRD was transposed into Romanian law through Ministry of Finance Order no. 85/2024 (“OMF 85/2024”) on 26 January 2024. Additional rules for auditors’ activities related to sustainability reporting are anticipated, though no timeline has been set for their publication. | Partially |

| 24 | Slovakia | 321 | 1% | Slovakia transposed the CSRD through Act No. 105/2024 Coll. amending the Slovak Accounting Act and other legislation (the Commercial Code, the Stock Exchange Act, the Commercial Register Act and the Statutory Audit Act), adopted on 24 April 2024 and effective as of 1 June 2024. | Yes |

| 25 | Slovenia | 193 | 0,4% | A draft bill transposing the CSRD requirements was introduced and the first reading in parliament took place in June 2024. Two acts have been amended, ZTFI-1C and ZRev-2C. | Draft |

| 26 | Spain | 3 136 | 7% | On 29 October 2024, the Spanish Council of Ministers approved the transposition of two European directives that standardize the framework for reporting and verifying sustainability information by companies (Corporate Sustainability Information Law), to be submitted to Parliament.The Draft of the Corporate Sustainability Reporting Law, amending the Commercial Code, Capital Companies Law and Audit Law and the size criteria for undertakings or groups for corporate information purposes, was published in the Official Parliamentary Gazette on 15 November 2024. In a meeting on 5 November 2024, the Council of Ministers authorized its urgent processing, which, among other aspects, halves the deadlines of the processing periods. https://portal.mineco.gob.es/es-es/comunicacion/Paginas/transposicion-directiva-europea-pacto-verde.aspx | Draft |

| 27 | Sweden | 1 709 | 4% | The Swedish Parliament adopted the bill to transpose the CSRD into local law on 29 May 2024, which entered into force on 1 July 2024.Sweden’s current transposing measures delay the start of these requirements to 1 July 2024, creating an uneven playing field across the EU. To address this, the Commission has sent a reasoned opinion to Sweden (INFR(2024)2195), urging it to correct this misalignment. | Yes |

| Unknown | 964 | 2% | |||

| TOTAL EU | 47 676 | 100% | |||

| EEA | Norway | 1 100 | On 11 June, 2024, the Norwegian Parliament adopted new legislation on sustainability reporting through amendments to the Accounting Act, the Auditor Act and the Securities Trading Act, formally signed by the King in Council on 21 June 2024. On 11 October 2024, the King in Council decided that the Norwegian legislation implementing the CSRD will come into effect on 1 November 2024. On the same day, the Ministry of Finance also decided transitional rules that provide a gradual introduction of the new requirements on sustainability reporting the next years, in alignment with the approach of the EU. | Yes | |

| EEA | Iceland | ? | |||

| EEA | Liechtenstein | ? |

—

Stay tuned for more CSRD and ESRS insights.

✅ Adopt a streamlined, digital and taxonomy-centric ESRS report preparation with Cleerit ESG.