The French Authority of Accounting Standards (ANC) has published a document contributing to the debate on the evolution of the CSRD and the ESRSs in the perspective of the Omnibus currently in preparation.

ANC advances proposals aimed at alleviating the burden resulting from the CSRD, while strengthening its effectiveness in managing the transition.

France was the first EU member state to transpose CSRD in Dec 2023 and the ANC has done a remarkable job of providing guidance to French companies on the ESRS.

ANC encourages us to “not lose sight of what’s essential: establishing robust standards applying to the communication of economic players means having the common language needed to understand each other and thus be able to make the right decisions”.

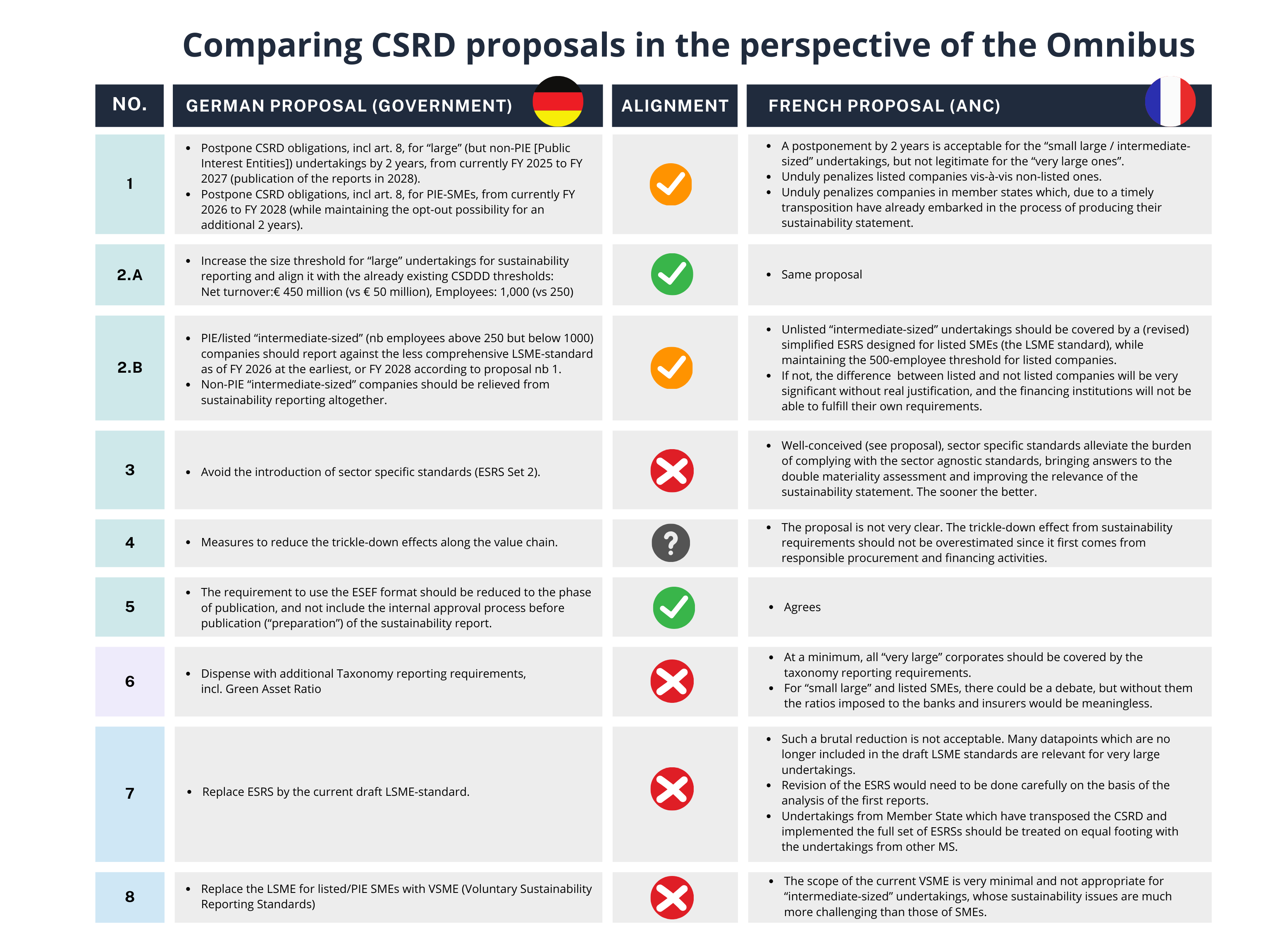

ANC proposes 4 measures. The first 2 can be summarized as follows:

⭕ Introduce more proportionality into the reporting requirements

➡️ Increase the size threshold, to take into account the specificities of “intermediate-sized” companies.

The European definition of a “large company” covers a large number of mid-sized companies, and the notion of “intermediate-sized”, does not exist in European law.

Adopting thresholds consistent with that of the CS3D (1,000 employees and €450m turnover) would therefore be a reasonable solution.

➡️ Reduce the scope by adapting and extending the LSME standards to these “intermediate-sized” companies (except if they are PIE companies with >500 and turnover >€50m).

Compared to the current ESRS, the LSME draft standards for listed SMEs simplify reporting by reducing the number of potential disclosures.

Given the broader scope of the companies concerned, they should then be subject to a new review and to a consultation.

➡️ Postpone the application by 2 years, to FY 2027 (publication 2028), for these “intermediate-sized” companies, (except if they are PIE companies with >500 and turnover >€50m).

However, such a revision should be finalized very quickly, so as not to put at odds the many member States that have faithfully transposed the CSRD.

⭕ Advance the review of the relevance of ESRS Set 1 for very large companies

The review is currently programmed for 2029 as stipulated in CSRD.

It should be advanced, but needs to be based on the lessons learned from the first sustainability statements that will have been produced and audited.

Taking into account the need for public consultation, in practice, this means 3 financial years with the current standards: 2024, 2025 and 2026.

To alleviate constraints, however, it is possible to extend the current transitional arrangements provided for in the ESRS by an additional year so that they do not end prematurely.

Source : ANC on LinkedIn >>

—

Stay tuned for more CSRD and ESRS insights.

✅ Adopt a streamlined, digital and taxonomy-centric ESRS report preparation with Cleerit ESG.